In 2023, several of Argentina’s biggest banks announced they would build new vaults to store rapidly depreciating bank notes. With prices rising by nearly triple digits at an annual pace, carrying stacks of rapidly devaluing peso notes has become routine and where citizens have unwillingly become currency traders out of necessity for survival.

However, necessity is the mother of invention. In a matter of years, Argentina has become a leading nation in digital asset adoption. Data from the Crypto Council for Innovation shows that one-third of Argentina now uses digital assets for everyday transactions and to hedge against currency depreciation and inflation.

If the concern is stability, not all digital assets offer the same reprieve. Even the most popularly listed coins can be highly volatile, fluctuating wildly based on sentiment on a daily basis. Additionally, most digital assets have high transaction fees attached, making smaller everyday purchases far more expensive.

Enter stablecoins. Because stablecoins are easy to trade and tied to the value of another asset—usually a stable currency like USD—more Argentinians are viewing them as a steadier and more dependable option compared to the Argentine Peso.

Argentina’s financial nightmare: A legacy of instability and the rise of stablecoins

Since the 1970s, Argentina has struggled with hyperinflation, beginning in 1975 when price controls led to soaring prices and a severe fiscal deficit. A second wave of hyperinflation hit in the late 1980s, reaching 2,600% annually in 1989-1990, nearly collapsing the banking system.

In response, Argentina introduced the Convertibility Plan, pegging the peso to the United States dollar at a 1:1 ratio. However, the plan proved unsustainable, ultimately failing during the 2001 financial crisis. Since then, inflation has remained a persistent challenge.

By 2023, inflation had exceeded 140%, fueling public support for radical economic reforms. Javier Milei, a self-described ‘anarcho-capitalist,’ campaigned to eliminate the central bank and fully dollarise the economy.

In December 2023, his administration deliberately devalued the peso by 50% to align it with black-market rates, exacerbating inflation and pushing poverty to nearly 50%. Amid this crisis, many Argentines have turned to stablecoins as an alternative currency.

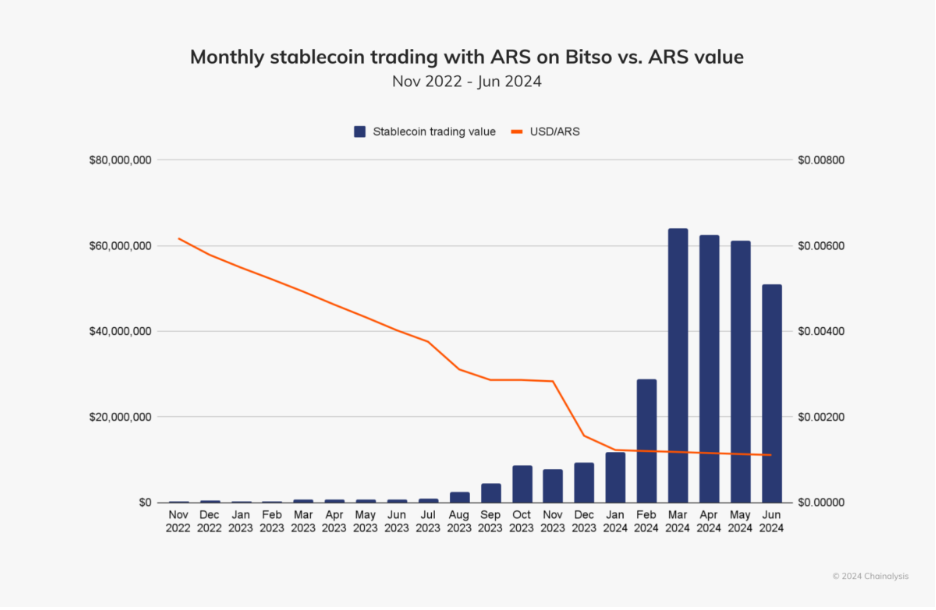

Data from Chain analysis shows a direct correlation between the peso’s decreasing value and an increase in monthly stablecoin trading.

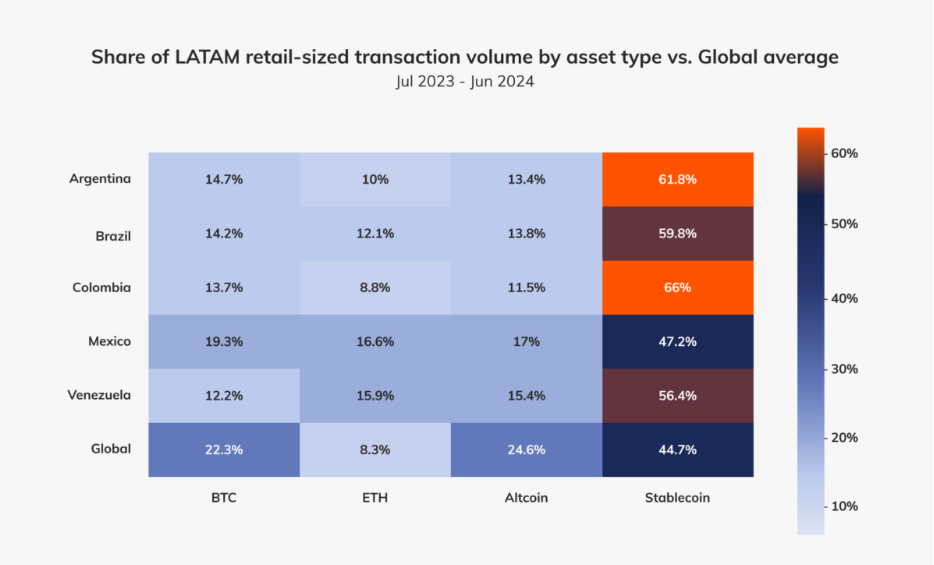

Additionally, retail-sized stablecoin value (transactions under $10,000) received in Argentina is growing at a faster rate than the value received in any other asset type (61% compared to the global average of 44.7%) once again suggesting that Argentinians look to stablecoins as a means of mitigating the effects of inflation and currency devaluation.

As a result, Argentina now leads South America in stablecoin usage, as these digital assets—pegged to fiat currencies—offer a hedge against peso volatility and enable faster transactions.

The benefits are multitude. Not only can citizens rely on a stable currency, but stablecoins are also much more accessible than traditional finance systems. In theory, all that’s needed is a connected mobile device. From there, purchasing, trading, and spending stablecoins is as easy as using an app.

Perhaps most significantly, stablecoins are gaining traction for remittances, a critical financial lifeline for many Argentinian families. Traditional remittance services often charge 5-10% fees and can take days to process. Stablecoin transfers, by contrast, can be completed in minutes at a fraction of the cost, allowing more money to remain in the hands of recipients who depend on these funds.

Beyond savings: Stablecoins as a basis for an economy

In this context, stablecoins represent more than just another financial tool—they offer clear and specific solutions to Argentina’s endemic financial problems.

At their core, stablecoins provide a stable store of value that can operate independently of Argentina’s inflation-prone financial system. This stability is particularly valuable in a country where the national currency has been corrupted by decades of mismanagement. By pegging to more stable external values, stablecoins provide Argentinians with a financial sanctuary from peso volatility.

This stability extends beyond individual savings. Small businesses in Argentina face enormous challenges in inventory management and pricing when the underlying currency fluctuates wildly. Stablecoins allow these businesses to maintain consistent pricing, plan inventory purchases, and engage in international trade without the constant recalculations required when operating in pesos.

The broader blockchain technology underlying stablecoins offers additional benefits through transparency and programmability. Smart contracts can create automatic, auditable systems for transactions, making it significantly more difficult to engage in corruption or financial manipulation. Every transaction is visible and permanent, meaning each participant can track how funds are transferred and used.

In regions where property rights are contested or poorly documented, blockchain-based registries can provide immutable records of ownership, bringing certainty to markets where uncertainty has long hindered development. This application extends beyond real estate to intellectual property (IP), business ownership, and other critical economic foundations.

Stablecoins also make financial resources widely available, as they only require Internet access, not physical banks or buildings. This could potentially bring millions of unbanked Argentinians into the formal economy overnight. With smartphone penetration being strong in Argentina, the foundation for widespread stablecoin adoption already exists.

MNEE: A stablecoin solution on the BSV blockchain

As stablecoins gain traction in Argentina, the specific underlying technology becomes increasingly important. Not all stablecoins are created equal, and the infrastructure supporting them can dramatically impact their utility for addressing Argentina’s unique challenges.

MNEE, a stablecoin powered by the BSV blockchain, is an example of the potential for these technologies to address Argentina’s financial needs at scale. Unlike stablecoins built on congested networks with high transaction fees, MNEE leverages the BSV blockchain’s unique technical capabilities to provide a solution tailored to Argentina’s economic realities.

The BSV blockchain’s architecture enables it to process thousands of transactions per second (TPS) at fractions of a penny—a critical feature for an Argentinian economy where even small fees can be prohibitive. Unlike other blockchains that sacrifice scalability for decentralisation, BSV prioritises throughput and affordability, making it viable for everyday transactions across Argentina.

MNEE’s low micropayment costs enable financial services that would be economically unfeasible on other blockchains where minimum transaction fees create natural barriers to entry. Street vendors in Buenos Aires, farmers in rural Córdoba, and shop owners in Mendoza can participate in this economy with minimal technical knowledge and without relying on potentially corrupt government or banking infrastructure.

Microtransactions Without the High Fees

— MNEE USD (@MNEE_cash) March 7, 2025

Sending $0.50 shouldn’t cost more than the payment itself.

Yet, traditional finance makes small payments impractical due to high fees.

MNEE on 1Sat Ordinals changes that—enabling seamless, low-fee payments for creators, gamers & digital… pic.twitter.com/vfbamF5Izr

Argentina’s crisis of institutional and financial trust can also be addressed with MNEE and the BSV blockchain’s ability to store extensive data on-chain, making it uniquely positioned to support transparent financial systems. While other blockchains can execute transactions, BSV’s data scalability allows for complete record-keeping and auditability without prohibitive costs.

Remittances: How stablecoins transform cross-border payments

Remittances represent a critical financial lifeline for millions of Argentinians with family members working abroad. Traditional remittance corridors between Argentina and countries like Spain, the U.S., and neighboring Latin American nations have historically been plagued by high fees, slow processing times, and opaque exchange rates.

Traditional money transfer operators often charge fees between 3-8% of the transfer amount, with exchange rate markups adding another 1-3% in hidden costs. The transfer can also take two to three business days to arrive. The same transaction using stablecoins can be completed for less than $1 in fees and arrive in minutes rather than days. For families depending on these funds for essentials like food, medicine, and housing, this efficiency isn’t just convenient; it’s transformative.

This efficiency extends beyond personal remittances to small business operations. Argentine entrepreneurs sourcing products internationally can now make payments without the cumbersome process of converting pesos to dollars (often at unfavorable rates) and then working through international transfers that take days to clear.

The transparency of blockchain-based stablecoins also eliminates a significant pain point in cross-border transactions: uncertainty. Traditional money transfers often leave both sender and recipient in the dark about exactly where their money is in the process. Stablecoin transactions provide real-time visibility, allowing all parties to track funds throughout the entire journey.

Stablecoins offer inclusion

Perhaps the most profound impact of stablecoins in Argentina lies in their potential to drive financial inclusion. Traditional banking cannot reach large segments of the population, particularly those in rural areas, those with limited documentation, and those working in the informal economy.

Stablecoins require only a smartphone and Internet connection— technology that has already achieved deep penetration across Argentine society. This accessibility transforms finance by bringing sophisticated financial services to previously excluded populations.

In rural areas, residents can travel hours to reach the nearest bank branch, making routine financial transactions burdensome and time-consuming. Stablecoins eliminate this physical barrier, allowing rural Argentinians to participate in the financial system as easily as their urban counterparts.

For Argentina’s substantial informal economy, stablecoins offer a bridge to financial services without the documentation requirements that have historically excluded participants. While traditional bank accounts require formal employment verification and extensive paperwork, stablecoin wallets can be created in minutes with minimal barriers to entry.

Financial inclusion isn’t just a social good; it’s an economic multiplier. Research from the World Bank suggests that broader financial inclusion correlates strongly with reduced poverty and increased economic growth. By bringing previously excluded Argentinians into the financial ecosystem, stablecoins can unlock productive capacity that has remained dormant under the traditional system.

Regulatory frameworks

For stablecoins to achieve their full potential in Argentina, appropriate regulatory frameworks must evolve alongside the technology. This presents both challenges and opportunities for Argentine policymakers.

Rather than resisting this financial innovation, forward-thinking regulators can embrace stablecoins while establishing guardrails that protect consumers and maintain financial stability. Countries like Singapore and Switzerland have demonstrated that thoughtful regulation can foster innovation while mitigating risks.

The BSV blockchain’s approach, which emphasises regulatory compliance rather than resistance, positions MNEE and similar solutions as particularly suitable for this regulated future. Unlike blockchains that prioritise anonymity or encourage circumvention of controls, BSV’s transparent ledger can work alongside existing regulations while delivering significant improvements in efficiency and access.

This regulatory compatibility makes stablecoins built on the BSV blockchain more viable partners for governments, banks, and enterprises looking to innovate within established legal frameworks, which is particularly important in a region where regulatory uncertainty often hampers technological adoption.

From crisis to opportunity

Argentina stands at a pivotal moment in its financial history. The combination of extreme currency instability, widespread smartphone adoption, and blockchain innovation creates a unique opportunity.

Rather than attempting to patch the broken peso system, stablecoins offer a parallel path—one built on technological foundations that address the very vulnerabilities that have plagued Argentina’s economy. This isn’t about replacing the peso overnight but providing Argentinians with viable alternatives that can compete on merit.

The adoption statistics suggest this transition is already well underway, driven not by policy mandates but by the practical needs of citizens seeking financial stability. As the adoption curve accelerates, knock-on effects will further enhance the utility of stablecoins. Each new user, merchant, or service provider accepting stablecoins increases the value of the network for all participants. This cycle can transform what begins as a niche solution into a mainstream financial system.

For a nation that has experienced the limits of traditional economic policy, stablecoins represent more than a technological curiosity—they offer a path to the financial stability that has eluded generations of Argentinians. By embracing this innovation, Argentina has the opportunity to transform its legacy of financial vulnerability into a future of economic resilience.

The stability that has remained elusive through conventional economic policies may finally be achievable not through central bank interventions or International Monetary Fund (IMF) bailouts but through adopting stablecoins built on scalable blockchain technology. For the millions of Argentinians who have spent their lives navigating financial uncertainty, this possibility represents nothing less than financial liberation.