Political instability, corruption, and economic volatility have long defined Latin America in global narratives. But beyond the headlines, a different story is unfolding—one of resilience, innovation, and transformation. By harnessing emerging technologies like blockchain, the region is expanding financial inclusion and establishing itself as a global hub for digital innovation, paving the way for a more connected and empowered future.

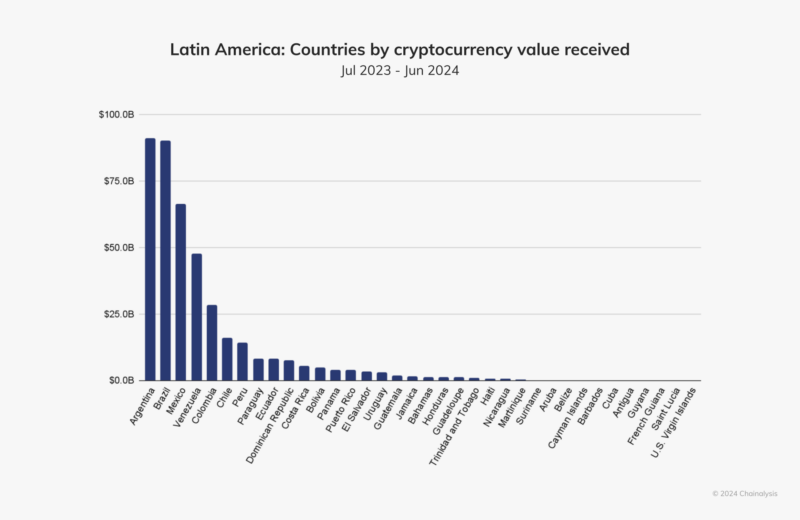

In 2024, a staggering 62% of Latin Americans reported using mobile wallets to frequently make digital payments. The region’s 42.5% year-over-year growth of its digital asset market was surpassed only by Sub-Saharan Africa between 2023 and 2024. Since 2021, its rates of financial inclusion have risen from an average of 16% to 28%.

This is a significant shift that has been partly borne by necessity. Relying on the traditional financial system has rarely paid dividends for those living in Latin America. In Argentina, for example, decades of political turmoil, failed monetary policies, and currency devaluations have turned ordinary citizens into unwilling currency traders, constantly calculating how to preserve their savings from evaporating overnight.The country has defaulted on its sovereign debt nine times since independence, most recently in 2020. Its inflation rates have frequently soared into triple digits, reaching over 211.4% in December 2023, the highest in three decades.

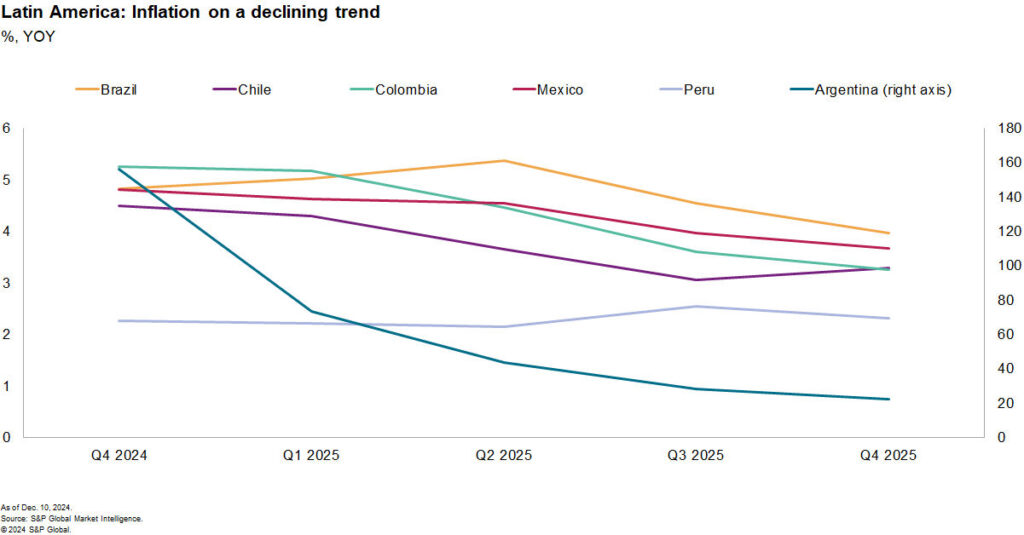

Argentina’s issues are not unique. Venezuela is perhaps the most dramatic example of economic collapse in the region, with hyperinflation reaching an almost incomprehensible 130,000% in 2018. Though this experience will differ greatly by country, Latin America’s average inflation rate is 14.41% compared to a global average of 6.78%.

No surprise, then, that countries across the region are currently undergoing a boom in digital asset use powered mainly by blockchain. According to Chainalysis’ Global Adoption Index, four Latin American countries rate in the top 15 for digital asset usage: Brazil, Venezuela, Argentina and Mexico.

The transformation is just getting started. Though payments have thus far been the most obvious use-case for blockchain in the region, the technology has far more to offer. The blockchain’s immutable ledger and programmable smart contracts combine to create a natural antidote to the failings of the traditional financial system: a system that does not rely on trust to work effectively. More than a mere incremental improvement, modern blockchain implementations represent a technological ‘leapfrog’ that could convert decades of financial vulnerability into a competitive advantage.

Blockchain beyond traditional finance

At its core, blockchain provides decentralised and immutable record-keeping that can operate independently of traditional financial institutions.

This immutable ledger has primarily enabled digital assets and decentralised exchanges, but its potential extends far beyond that. An immutable ledger free from manipulation can be an invaluable asset in regions where institutional trust has been corrupted by financial mismanagement. By distributing control across a network rather than centralising it, blockchain is inherently resistant to manipulation and corrupt government officials.

Many blockchains, including the BSV blockchain, even have smart contract capabilities. Smart contracts are self-executing bits of code that can be written into the ledger, allowing events to be triggered based on events on the ledger. A simple example would be a given non-fungible token (NFT) automatically reverting to its original owner should a pre-defined license fee not be paid on time.

In the context of government, however, smart contracts could be used to automatically assess and apply taxes to a given transaction based on publicly accessible conditions such as its size and type. By removing the human element from what ought to be the mechanical application of a tax regime, the scope for corruption is massively reduced.

Similarly, in regions where property rights are contested or poorly documented, blockchain-based registries can provide immutable records of ownership, bringing certainty to markets where uncertainty has long hindered development.

This vision does more than protect and promote trust in government and the financial system. In a world where government record books are publicly accessible and auditable and where individuals transacting do not need to be mediated by a third party (such as, for example, a clearing house), trust never enters the equation.

The rapid uptake of digital assets by the region’s citizens shows that if traditional financial systems don’t work for them, they will seek alternatives. If governments – and the traditional financial system – are to avoid being cut out of these new paradigms, they should closely examine what lessons they can learn from them. That means embracing the reliability and transparency of blockchain.

Choosing a technology: A solution for Latin America

As has been made clear above, Latin America’s financial systems are facing big problems, and any solution will need to be future-proofed and capable of operating at a national scale.

The BSV blockchain is a strong fit as it is uniquely suited for national-scale financial infrastructure. The BSV blockchain’s architecture enables it to process thousands of transactions per second (TPS) at fractions of a penny, a critical feature for Latin American economies where even small fees can be prohibitive.

This scalability isn’t theoretical; it’s being demonstrated right now with BSV’s Teranode, an advancement which has reached over 3 million TPS without suffering bloated transaction costs. For Latin Americans already using stablecoins as protection against currency devaluation, the BSV blockchain provides a more cost-effective rail for these transactions, preserving more of their hard-earned savings.

What could your business achieve with this type of scalability, at a fraction of the cost?

— BSV Blockchain (@BSVBlockchain) February 26, 2025

Discover more #blockchainsolutions in the full talk here: https://t.co/n2onDALrxW#WEF25 @ftlive #BusinessInnovation #DataSolution #DataProcessing #BusinessData pic.twitter.com/9sT7atnWU3

The BSV blockchain’s low micropayment costs enable financial services that would be economically unfeasible on other blockchains where minimum transaction fees create natural barriers to entry. Street vendors in Mexico City, farmers in rural Peru, and petrol station workers in Buenos Aires can participate in this economy with minimal technical knowledge and without relying on potentially corrupt government or banking infrastructure.

Latin America’s crisis of institutional trust can also be addressed with the BSV blockchain and its ability to store extensive data on-chain makes it uniquely positioned to support transparent public spending through smart contracts.

While other blockchains can execute smart contracts, the BSV blockchain’s data scalability allows for complete record-keeping and auditability without prohibitive costs. Records as vast as government expenditures in countries like Argentina or Brazil can be recorded on the BSV blockchain, creating immutable audit trails accessible to citizens and watchdog organisations.

Notably, the BSV blockchain maintains a stable protocol, avoiding the constant changes and upgrades that impact other blockchain projects. This stability is crucial for long-term infrastructure development in Latin America, where businesses and governments need assurance that systems built today will function reliably tomorrow.

Discover how the BSV blockchain can drive transparency, trust, and economic growth across Latin America at MERGE. Don’t miss this opportunity to explore the future of digital finance. Register now to learn more.