Capitalising on the fast and cost-effective payments rail provided by BSV, Money Button is a fully-featured yet incredibly simple interface to digital currency payments for businesses and customers alike.

Money Button is a simple payment system designed to make sending money over the Internet the easiest task you can possibly do, both for businesses and consumers, says Money Button founder Ryan X. Charles.

‘What we want to do with Money Button is eliminate all of the barriers for sending payments over the Internet, solving issues like transaction fees and user experience to make the entire process as simple as it could possibly be.’

Sending payments through Money Button is, as its name implies, as simple as swiping a button. Designed to emulate the intuitiveness of the Facebook like button, the system effectively functions as a barrier-free onramp to the BSV ecosystem.

‘Money Button doesn’t just provide payments however,’ says Charles. ‘Over time, Money Button will provide every feature that BSV provides.’

For businesses and users that require more advanced capabilities – things like smart contracts and data functionalities – Money Button combines them into an easy-to-use but feature-laden package.

‘From a business perspective, Money Button is a way for that business to engage with the blockchain that allows them to focus on their business,’ says Charles.

Services like Money Button provide the interface for users to interact with the BSV blockchain, and they are therefore designed to be easily integrated and as accessible as possible.

‘What we do is solve all of the technical challenges in mapping a business to the blockchain, and for the end user, all they need to do is swipe Money Button to send that payment.’

Micropayments made easy

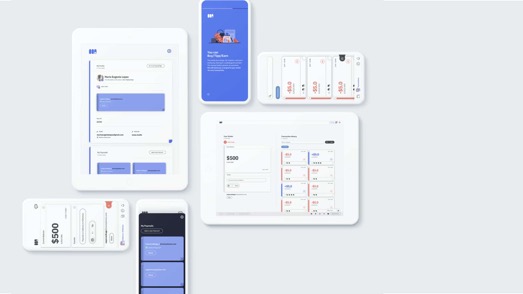

Interacting with Money Button as an end-user is as simple as registering for an account, which will open users a BSV wallet and assign them a Paymail address – effectively an email address that allows direct peer-to-peer transactions to be sent and received between users.

Funds can be added to Money Button from any external BSV funding source, after which it is represented in a chosen fiat currency inside the wallet. From there users are able to transact directly with each other or interact with Money Button-enabled businesses. Paying is as simple as swiping Money Button to authorise a payment, which is deducted straight from the balance inside the Money Button wallet.

Businesses that have incorporated Money Button into their application or website have the added benefit of being able to offer an integrated user experience, with the Money Button wallet serving as a sign-in credential attached to their login, while also enabling paid features related to access, subscriptions or purchases.

‘What we are doing is creating a method that can eliminate every possible barrier to onboarding users to this technology. That means reducing the number of steps required to sign up to Money Button, acquire BSV and then use it in an application, as close to zero as possible – that’s always been a key focus for our business’ says Charles.

‘For a business, the functionality they gain with Money Button is extremely sophisticated, but for the end user, it’s very simple – just swiping a button and making a payment.’

‘We have enough businesses that are using Money Button right now that we’ve been able to gain some key insights into what the most important priorities for businesses are and the feature set that they require,’ explains Charles.

Money Button continues to build out a host of new features that make it even more useful to businesses that want to integrate blockchain functionality.

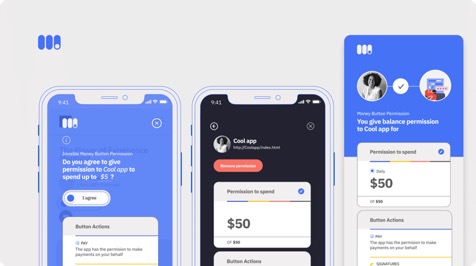

An example of this is ‘Invisible Money Button’, which lets users authorise automatic payments or create custom rules for payments – effectively granting permission for a business to swipe Money Button for a user. The feature allows businesses to create premium, commercial user-experiences – such as subscription-based content models – without the need for manually making a payment each time.

‘The swipe-based interface was carefully designed to have the best user-experience for most use cases, but it could never be the best user-experience for every use case,’ explains Charles.

‘With Invisible Money Button, the button itself never appears on the screen. This makes advanced applications much more user-friendly, such as micropayments in social media, messaging apps, and uploading data to the blockchain.’

Choosing BSV for payment services

Charles explains that Money Button emerged out of a different project called Yours, which he tried to implement on several other blockchains with smaller block sizes.

‘This is how we got involved in the block size debate. It was very clear to us that the correct path forward was to have large blocks – that’s why we choose BSV.’

With significant experience building on other blockchains – including those still at concept stage (he was the first engineer hired by Reddit when they were pursuing their own digital currency project) – Charles advocates for the developmental potential of the BSV blockchain.

‘The key advantage of BSV is very simple – it’s a fixed protocol and it scales – as a business, that’s really all you need to know,’ explains Charles.

‘From a more technical perspective, there is no upper bound on the block size, but also, the way that businesses build infrastructure and create or validate transactions can be done in parallel and in pipelines. [BSV] is designed exactly like a real-world distributed computation, storage and transmission system that is intrinsically scalable – other blockchains are not.’

It is not just the benefits of the underlying Bitcoin SV platform which has enabled Money Button to flourish, but also the growing ecosystem of businesses that are using the digital currency.

Since moving to BSV, Money Button has been used millions of times for various applications and platforms, and it has facilitated tens of millions of dollars in payments with volumes growing exponentially.

In line with this growth, Money Button has also continued to launch powerful new features that enable further functionality for users and businesses. These include a tokenisation API which allows companies to create, send and receive utility tokens integrated into their platforms through the BSV blockchain. The platform’s user interface is also being constantly refined to deliver the best user experience possible, making it easy to interact with blockchain payments and BSV.

‘We have more than 150 active businesses that are using Money Button already to either allow user payments insider their apps or write data to the blockchain,’ Charles says.

‘That’s already a strong active group, but we see tremendous growth. The ecosystem of businesses using Bitcoin SV is growing rapidly and that can only mean good things for Money Button.’