A delegation from the BSV Association recently attended the MERGE Argentina event to discuss how blockchain technology can be deployed in Latin America. The event, which took place from March 24 – 25, 2025, was focused on bridging the Web3 ecosystems of Latin America and Europe into a single, unified gathering.

A key panel discussion from the event focused on stablecoins and how central bank digital currencies (CBDCs) and tokenised cash can be used in the region. Director of Growth at the BSV Association Martin Coxall, who spoke on the panel, explains that this is a particularly hot topic right now, given the popularity of the technology in the region.

“Argentina’s a great example because they are ready to pull the trigger,” Coxall said. “President Javier Milei was elected on the platform of ‘dollarising’ the economy, and he has essentially given up on the local currency – the Argentinian Peso. He is kind of a mix of Elon Musk and Donald Trump all rolled into one, with a bit of Latin flavour, and he has got very strong ideas of how to fix the Argentinian economy.”

Coxall explained that Argentina is particularly well suited to adopting a stablecoin backed by the dollar as the country has been effectively using the greenback as a second currency for almost three decades.

🚀 Panels You Can’t Miss Today at MERGE Buenos Aires! 🚀

— MERGE Madrid & Buenos Aires (@mmerge_io) March 25, 2025

Stablecoins, CBDCs & Tokenized Cash: Implications in Latam

🕓 16:40 – 17:10 | ikigii Main Stage | 🇪🇸 Spanish

Speakers:

Juliana Schlesinger Felippe – @transferogroup

Magdiela Rivas Núñez – @notabene_id

Martin Coxall –… pic.twitter.com/5ppDS168JE

Many Argentinians have turned to the U.S. dollar as a store of value, but strict regulations limit access to foreign currency. Stablecoins, particularly those pegged to the dollar, offer a digital and accessible alternative for savings and transactions, providing financial stability in an otherwise volatile economy.

“On a day-to-day basis, people in Argentina use the dollar,” said Coxall. “They will pay for stuff in dollars, receive dollars, and accept income or remittances from outside of the country in dollars. This is understandable because it is far more stable.”

Additionally, Argentina has a strong crypto adoption rate, with many businesses and individuals already using digital assets for everyday transactions. Coxall added that most daily trade of goods is done using the dollar, which is also the key currency used for remittance payments made into the country.

“At some point, they are going to want to (switch to the dollar),” Coxall said. “The problem is that you can only do that on a cash basis. You can’t send dollars everywhere, and not everybody has access to dollars across the whole country. So if you want to replicate that on a countrywide scale, you will need some kind of digital version.”

BSV blockchain key for adoption

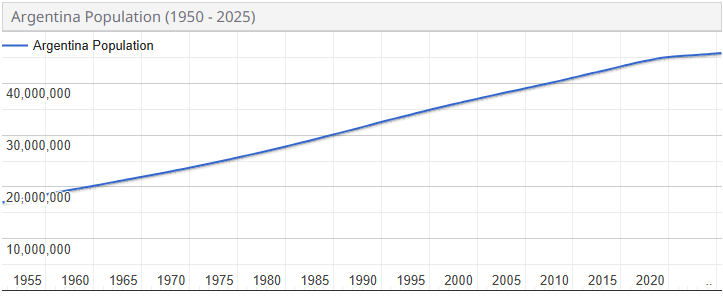

Based on competing blockchains such as Cardano and Polygon, several USD-backed stablecoins already exist in the region. However, it will be necessary to use a stablecoin based on the BSV blockchain sometime soon to allow for scale adoption, said Coxall. He explained, “The current stablecoins are fine if you apply them to a small group of people—maybe 100,000 people across the entire country. But there are over 40 million people in Argentina who will need to use stablecoins daily, multiple times a day, all year round. That is a lot heavier in terms of transactions and the current stablecoins come with high gas fees because they are all based on proof-of-stake platforms.”

The primary constraints include:

- High gas fees;

- Limited transaction processing capabilities;

- Inefficient infrastructure for mass adoption.

Because of these issues, a stablecoin based on the BSV blockchain, which has incredibly low transaction fees, is the only real scalable solution for Argentina, said Coxall. Traditional financial systems in the country are burdened with high fees, slow processing times, and strict regulations that make transactions costly and inefficient, especially for those relying on digital payments or cross-border transfers.

The BSV blockchain offers a fast, low-cost, and scalable infrastructure, making it an ideal platform for a stablecoin that can provide Argentinians with a reliable alternative to their unstable local currency. By leveraging the BSV blockchain’s efficiency, a stablecoin could enable seamless everyday transactions, protect savings from inflation, and promote financial inclusion in a country where many people lack access to stable banking services.

Inflation in Latin America is double the global average.

— BSV Association (@BSV_Assn) March 24, 2025

For too long, financial instability has shaped life in Argentina and Brazil. But a new financial era is emerging: one where stable, scalable, and low-cost digital money is accessible to all.

This recent CoinGeek article… pic.twitter.com/3BU9hWeyzu

Regulatory-compliant stablecoins

Another key reason behind the adoption of BSV blockchain in the region is that it is regulatory-friendly, argued Coxall.

“It doesn’t make us very popular (with the crypto community), but we offer the one version of a stablecoin which has built-in legal measures. This includes the ability to freeze and seize anything that has been used for improper purposes,” he said.

Coxall noted that other stablecoins and competing chains could also offer this functionality, in theory, but it would require significant amounts of time and technical reworking. A stablecoin built on the BSV blockchain would be the only one where a government or legal institutions could have direct control over all the stablecoins in that currency,” he explained.

By being the regulatory-friendly blockchain, it is also the one with the most safeguards in place, said Coxall.

“We are also one of the few groups advocating for the better regulation of blockchain and crypto overall,” he said. “We are very aligned with what’s being done in the U.S.— such as the GENIUS Act recently signed by President Trump. We are also working towards alignment with the Markets in Crypto-Assets Regulation (MiCA) Act and regulation in the European Union,” he shared.

“Even though those are two very different pieces of legislation, we are onboard and aligned with both of them. That’s important because most of South America is going to be influenced by those two markets due to the close ties to North America and Europe. So it’s a no-brainer from that standpoint.”

A turning point for Argentina and Latin America

The potential deployment of a BSV blockchain-based stablecoin in Argentina could mark a significant turning point in digital financial infrastructure. By providing a reliable, low-cost, and legally compliant alternative to traditional banking, such a solution has the potential to promote financial inclusion, shield citizens from currency volatility, and enhance economic transactions’ efficiency. In addition, it could serve as a model for other economically challenged regions.

The discussions at MERGE Argentina highlight a crucial shift in financial technology, signalling that blockchain is evolving from a speculative concept to a practical tool for addressing real-world economic challenges.

The BSV blockchain’s approach—balancing technological innovation with regulatory compliance—offers a pragmatic path forward, ensuring user needs and legal frameworks are met. As Latin American economies continue to seek solutions to persistent financial challenges, blockchain technologies like the BSV blockchain are well-positioned to play a transformative role in reshaping the region’s financial landscape.

Watch: How Blockchain is Transforming Business Beyond Crypto